Welcome to Money Talks! New approaches to money have exploded. Yet, money remains taboo. Less than half of you share personal finance information with your friends and family.

But that’s all changing. Now more and more of you are talking about money because it leads to better outcomes.

In an effort to provide personal finance insights through transparency (and have a bit of fun), I’ve created a series titled Money Talks that showcases how real people in Charlotte approach money.

It’s an anonymous way for you to share your money experiences and insights with our city. Answers are lightly edited for clarity and privacy (ex, exact age). Want to participate? Take the Money Talks survey.

Here’s a look at the personal finances of a 31 year old without kids.

Salary:

I’m a startup CEO/entrepreneur. Right now, my salary is less than $50K a year. It’s the nature of startups.

I worked a corporate job out of college where I made roughly $60K. Then I got into business ownership where it fluctuated from $0 to $260K. Most of my net worth is tied up in owner equity. I’ve kept in touch with friends from my corporate job and they’re all making roughly $200K – $225K. As an entrepreneur, my salary has been less than my peers, but I’ve sold 2 businesses for a combined $1.8M.

Other income:

I’ve got annual investment income of around $110K. I invest in equities, treasury bonds, private lending, startup investing, and crypto.

My steadiest and highest yield investment is in private lending where yields are typically 9-11% annually with a lot of downside protection. I got into these opportunities via the entrepreneurial network.

Living situation:

I purchased an Uptown condo 10 years ago and refinanced it in 2020 at a 3.6% rate.

Work/life balance:

It fluctuates, when things are taking off it can be 80-100 hours per week. When things are more neutral I can be flexible. As an entrepreneur, there isn’t a PTO policy or anyone keeping tabs on you other than yourself — this is a blessing and a curse, especially if you’re not disciplined about it.

I also enjoy working on weekends, it’s a great time to get caught up and do focus work. It doesn’t feel like a job when you truly love what you do.

Debt:

I have a mortgage with $220K left on it. Our monthly payment is $1,300. I also have a $1,000 monthly car payment. I typically pay off credit cards weekly.

My general approach to debt is to take as much of it as I can if it means investing cash in other higher yield opportunities. For example, if the debt interest rate is 4% but I can make 10% in private lending I am going to borrow at 4% all day long.

Credit card:

I need to be a lot better about this. I currently use the AAdvantage card and the Citi DoubleCash card. I’ve heard the Chase Sapphire and Amex cards are where it’s at though.

Budgeting:

Yes, but very loosely. I use the Rocket Money budgeting tool that integrates with all of your accounts. I also use a few other tools for tracking total net worth.

I highly recommend starting with the big picture and grasping your total net worth. Then getting better and managing your money on a yearly and monthly basis.

Recurring expenses:

The best is Eight Sleep, although I don’t love that they charge a subscription for the mattress pad. It’s been the best sleep I’ve ever had and I can’t put a price on that.

The most annoying expense is probably Experian, they do credit scores and identity protection. A few years ago I got alerted that a bunch of my private information was on the “dark web” and naturally this freaked me out and I have paid $24 per month ever since for identity protection.

Splurge:

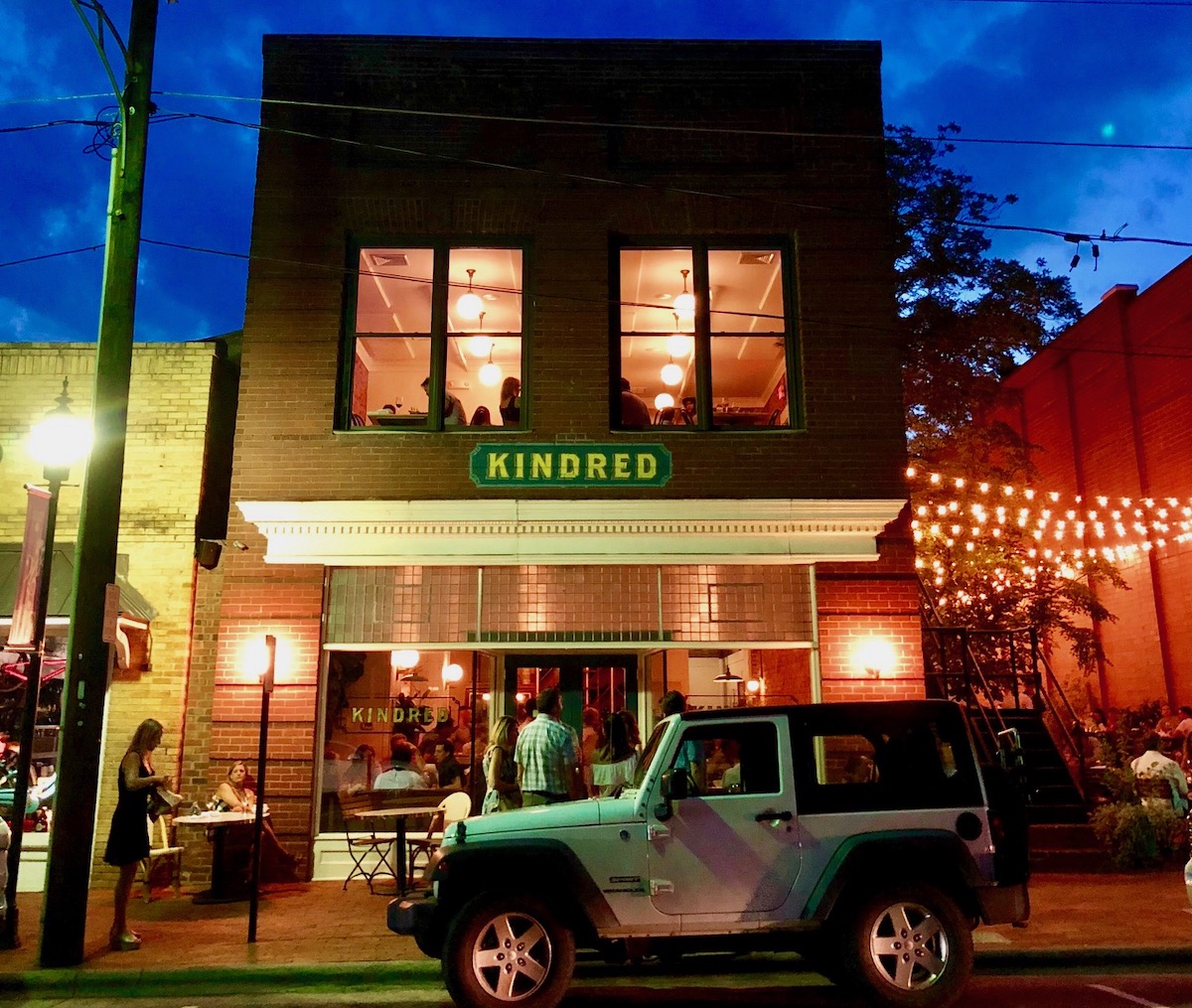

Food (and sleep). I don’t care for fancy cars or items, but I will absolutely splurge on an amazing food experience. I highly recommend checking out Counter or the Chef’s Table at Kindred.

[Ted note: Chef’s Table seats 10 👇 and has a $1,750 food and beverage minimum on weekends, plus 22% required gratuity and tax. It’s awesome.]

Charlotte money hack:

Get into private lending, the yields are amazing and the downside is protected by the underlying asset itself. Especially if the fund you’re investing in is targeting growth markets like Charlotte.

Net worth:

$1.8M. I generated this net worth via selling two companies, some inheritance, investments, and not having a high personal burn.

I have $1.4M invested right now and other equity tied up in two properties. I have a financial advisor, but my take is that it’s not worth it. If you have even a little bit of time and willingness to learn, you can buy treasury bills on your own, invest in ETFs, use robo-advising, directly invest in startups, participate in private lending, and more.

I try to split my portfolio up this way — 15% in risky things (startups, art, alternative investments), 35% in real estate, and 50% in equities.

My biggest piece of advice is to save as much as you possibly can as early in your life. Live well below your means for the first 10 years out of college, bank everything — and then let that work for you in your 30s. If you do this, your future self will thank you. There are a lot of ways to have fun without having a $150+ bar tab at the end of the night.

Retirement:

I’d love to retire by 40 with $5M. At that point I’d love to work on other projects that are purely for fun, businesses I find exciting, and do startup investing.

Having $5M could generate $300-$500K in annual income, which is more than enough to live off of.

This would give myself and future family (I want to have 2-4 kids) the freedom of choice and flexibility. I’d love to be able to help my family with money. On a different note, I’d love to have a mountain home. My plan is to continue to build and sell businesses, live life frugally until I’m in my late 30s, and to invest aggressively.

What do you consider “rich” in Charlotte?

Having $1M+ in mostly liquid assets, but then again — I feel like Charlotte has become so expensive that you can’t really get away with living anywhere semi-close to the action without paying more than $600K for a house. So maybe $1.5M is a better answer.

Best and worst money decisions:

They’re the same, haha. Best were a few moonshot investments in crypto and startups that 10X. Worst, were a few moonshots in crypto and startups that went to $0.

Charlotte restaurant:

It’s a bit of a hidden gem so let’s make it a scavenger hunt…. their best item on the menu is named “The What It Is.”

[Ted note: Since I’m a nice guy, so I’ll save you some investigative time, the “What It Is” dish is the famous blackened chicken over pasta in Cajun cream sauce from Al Mike’s! Can confirm that it’s delicious…]

Want to participate? Take the Money Talks survey. Got feedback? Email ted(at)tinymoney and I’ll include it in our newsletter Mailbag section. New to Tiny Money? Join 5,098 Charlotte execs and subscribe to my 1x/wk newsletter. Job hunting? View job board.